Financial Planning and Asset Management

PRIME CAPITAL FINANCIAL OF CONNECTICUT

What is Your Risk?

Find out in 5 minutes.

Manage risk while not missing out on growth.

Get started by clicking the button below.

Building a Better Financial Future—Together

Confident financial decisions start with the right guidance—discover how we help individuals and families build lasting security.

At Prime Capital Financial of Connecticut, we are dedicated to delivering meaningful financial guidance and long-term value to individuals and their families through personalized planning and trusted advice.

A Financial Advisor plays a crucial role in a Client’s financial life serving as their trusted guide and expert in navigating the complex world of personal finance. Our experience, knowledge and fiduciary-based guidance are invaluable when it comes to creating and implementing a comprehensive financial plan tailored to an individual’s unique circumstances and goals.

One of the primary benefits of working with Prime Capital Financial of Connecticut is our ability to provide an objective perspective. We analyze each person’s financial situation taking into account their future goals, income, expenses, assets, liabilities, risk tolerance and time horizon. By considering these factors, we can help identify areas of improvement and develop strategies to maximize their financial resources and probability of success.

At Prime Capital Financial of Connecticut, we have access to a wide range of investment products and analyses that can help individuals reach their financial goals based on their risk tolerance and timeline. Whether it’s retirement planning, saving for education, or wealth preservation, Prime Capital Financial of Connecticut can create a diversified investment portfolio that aligns with your individual long-term objectives.

- Risk Profile Assessment

- Retirement Planning and Goal Setting

- Cash Flow Analysis and Budgeting

- Investment Planning and Analysis

- Insurance Analysis

- Estate Planning

- Education Planning

Take the first step toward a more secure financial future. Request your free consultation today.

Bringing Clarity to Your Financial Future

Personalized planning and protection strategies to help you build a secure future for yourself and those you love.

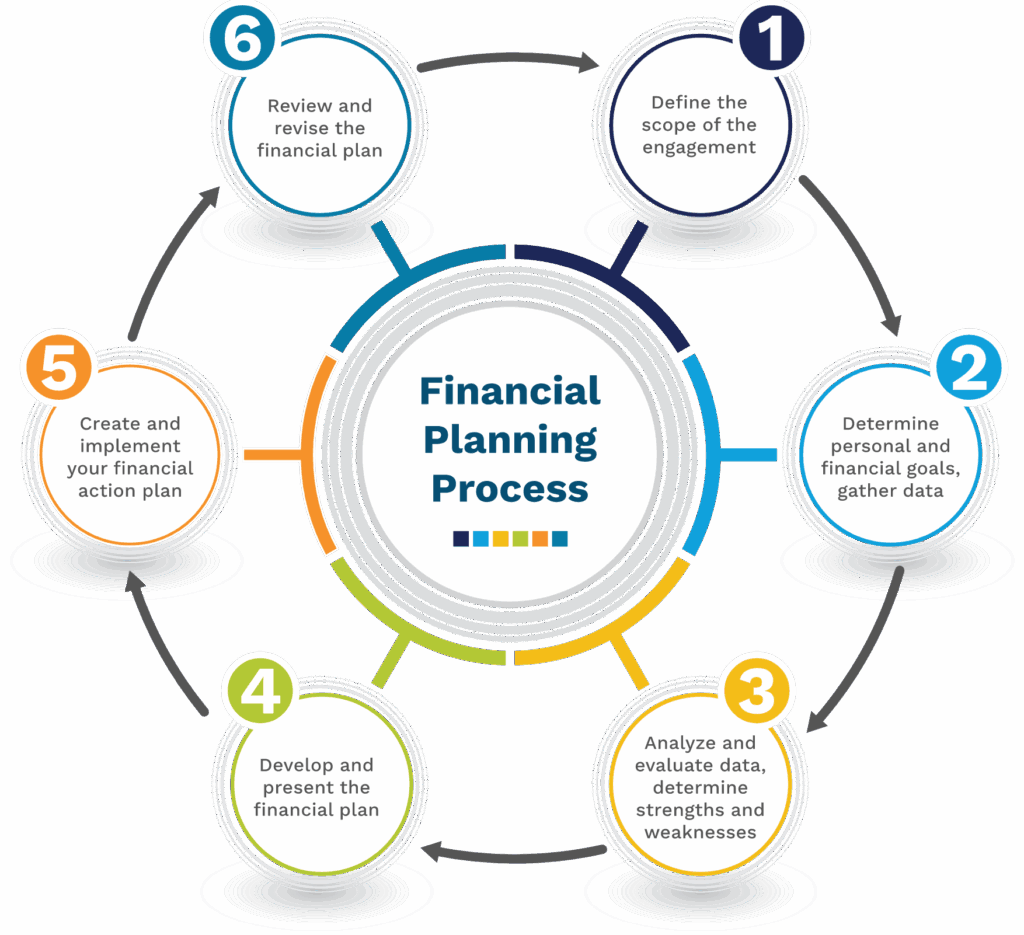

We offer the professional knowledge and guidance required to develop a plan that reflects your personal goals and dreams and brings all of the pieces of your financial life together. For over 30 years, we have gained the confidence of our clients by providing comprehensive and objective financial advice formalized by a written plan.

Financial planning encompasses key aspects of your financial life and should be tailored to your unique circumstances. In addition to the cash flow scenarios, accumulation goal planning, and success rate modeling, an essential piece of our financial planning process is having a plan in place to take care of your family. We will help clarify your insurance needs. Whether you need life, disability, or long-term care insurance, we’ll work with you to create a personalized insurance plan to protect what matters most.

Financial Assessment & Goal Setting

Insurance Analysis

Take the first step toward a more secure financial future.

Request your free consultation today.

Personalized Portfolios

Built with Purpose

We don’t predict the future. We help you prepare for it—with investment strategies tailored to your life.

Since past asset class performance is not a guarantee of future performance, in our opinion, well-crafted investment strategies must not only acknowledge that future market movements are uncertain, they should plan for it!

Our asset allocation philosophy considers your risk tolerance, time horizon, liquidity needs, investment objective(s), and investment experience before we make a portfolio recommendation. We offer a wide variety of investment strategies (including personalized portfolios, private debt and equity opportunities and third-party managers) to fit your needs.

We use a robust online tool to help our clients find their personal risk number. Your risk number is unique to you and is one of the biggest factors in determining an asset allocation for a client. The higher the number, the more comfortable you are taking on risk in pursuit of financial independence.

Risk Management &

Portfolio Analysis

Investment Management & Analysis

Your Financial World—At Your Fingertips

Smart tools, secure storage, and real-time tracking—all designed to put you in command of your financial journey.

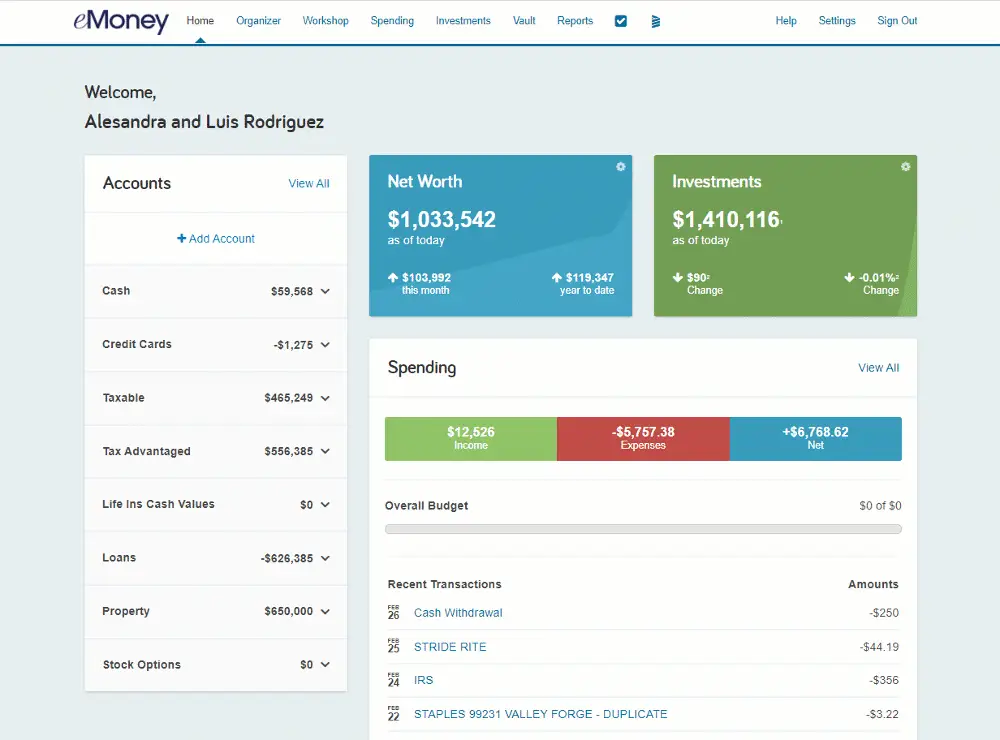

With the eMoney platform, you can securely view your accounts from your desktop, tablet, or mobile device—whenever you need, wherever you are. eMoney offers a powerful combination of convenience, security, and reliability, making it a trusted solution for individuals and businesses. With eMoney, you can:

- Connect all your accounts for a consolidated view of your financial picture

- Monitor all your accounts by viewing interactive charts

- Safely store your most important financial documents in the vault

- Customize your dashboard to reflect the data points most important to you

Don’t Miss Out on the Latest Insights—Sign Up Now!

Stay informed and empowered with the latest financial insights, tips, and updates delivered straight to your inbox.