Excessive Fee Litigation: The Best Defense is Compliance

Excessive fee litigation is increasing at a steady pace and all signs are it will continue to increase. The positive side of this situation is that we now have more caselaw to consider as we work toward compliance in creating a “best defense”. Early caselaw did not reflect the consistency of court decisions. Some court rulings were in direct conflict with those of other courts, and some did not seem well reasoned.

Retirement Plan Committee Activities

A retirement plan committee consists of co-fiduciaries who are responsible for all plan management activities that have been delegated to them by their plan’s named fiduciary.

Collective Investment Trusts

For almost a century, collective investment trusts (CITs) have played an important role in the markets. They were originally introduced in 1927.

IRS Audit Tips

The Internal Revenue Service’s (IRS’s) Employee Benefit Audit Program is used to audit and enforce. The IRS’s emphasis, with respect to defined contribution plans is on compliance with the requirements of the Internal Revenue Code (the Code), the plan’s tax qualification and administration of all plan documents. In the event of noncompliance with regulations, the IRS can impose taxes, penalties and interest.

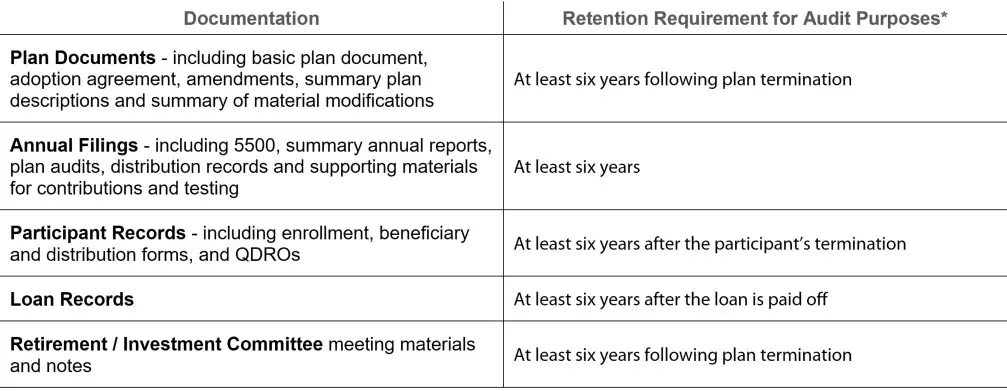

Record Retention

You don’t need to be a magician to know what records to keep and for how long. While most providers can supply reports and plan documents, the plan administrator remains ultimately responsible for retaining adequate records that support the plan document reports and filings. Refer to the chart below to know which documents you need to keep in case of a plan audit.

What’s the Magic Number When it Comes to Record Retention?

You don’t need to be a magician to know what records to keep and for how long. While most providers can supply reports and plan documents, the plan administrator remains ultimately responsible for retaining adequate records that support the plan document reports and filings. Refer to the chart below to know which documents you need to keep in case of a plan audit.

Top Ten Fiduciary Responsibilities

A plan fiduciary plays an important role in the organization’s financial health. Not only do they oversee the fiduciary process, but they identify and serve the best interests of a retirement plan’s participants and beneficiaries. Here are 10 important responsibilities to keep in mind.

The Auditors Are Coming—Are You Ready?

No one wants to be caught flat-footed when the auditors come calling. And with a new standard issued by the American Institute of Certified Public Accountants (AICPA), both the auditors and plan sponsors will be subject to new responsibilities.

Financial Hypochondria: When Investment Vigilance Becomes a Problem

Plan Sponsors invest much time and effort in improving employee financial literacy. They offer educational content, provide opportunities for group and individual consultation, and encourage participants to approach retirement planning proactively by staying on top of their investments. But what happens when workers go overboard with well-intended advice?

Plan Conversion in Volatile Markets

Your team has undertaken the due diligence to research various service providers. Based on a myriad of data points, experience, potential interviews of candidates, internal analysis and discussion, your team has decided it is prudent to change your plan’s recordkeeper(s).